Humble Beginnings

In 1971, Mary Elaine Meyer O’Neal donated 20 acres of land along Airport Road, laying the groundwork for what would become The O’Neal School. This generous gift, along with land previously contributed by the Meyer family for the construction of Sandhills Community College, was meant to “close the parenthesis” and establish a lasting foundation for education in the region. It was given with the simple hope to foster learning without any expectation of financial gain in return. The school initially opened with three teachers and 35 students, operating out of the Campbell House in Southern Pines before relocating to its current site in four mobile units just a month later.

Building the Campus

As its ambitions grew, the Board of Trustees began authorizing debt to expedite construction projects. The school took on a $10,000,000 bond, substantially increasing yearly financial obligations. Millions were spent constructing Meyer Hall, Bradshaw Hall, Taws Hall, McMurray Hall, and the Hannah Marie Bradshaw Activities Center, transforming the campus into a symbol of progress. However, this rapid growth came with financial risks that would soon threaten the institution’s stability.

Drowning in Debt

By 2013, The O’Neal School faced potential financial collapse with over $11,000,000 in liabilities. While the Board Chair blamed the recession for the school’s financial troubles, records show actual revenue declined by only approximately 6% for one year. The true cause of the crisis was the Board’s reckless spending which created unsustainable debt. Desperate to keep the school afloat, they sought funds from all possible sources, including loans and additional donations. Despite these efforts, the bond could not be fully paid off.

Property Sold to Private Investors

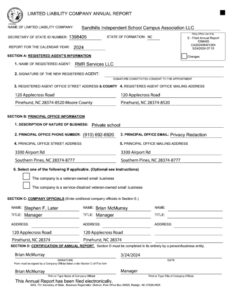

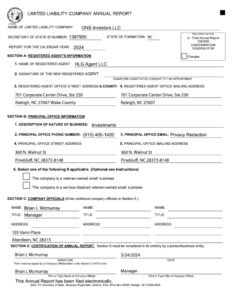

The Board turned to Brian and Konni McMurray who offered a solution: the private purchase of half of the school’s campus assets. Key members approved the transaction including Stuart Mills (Chairman), Konni McMurray (Vice Chairman), Lee Howell Jr. (Secretary), Laurie Trexler (Treasurer), Lynda Acker, Stan Bradshaw, and Headmaster John Elmore. The school transferred the entirety of their 40-acre real estate holdings to the Sandhills Independent School Campus Association LLC with Stephen Later, a Trustee and lawyer, named as the registered agent. Shortly thereafter, this LLC was transferred to a newly formed private entity, ONS Investors LLC.

The McMurrays assumed or paid off the remaining bond, acquiring 50% ownership of ONS Investors LLC. The school, now the owner of the remaining 50%, began paying a leasing fee for continued use of the campus which it also fully maintained. This marked a significant shift, transitioning O’Neal from a true non-profit institution to a shared investment vehicle benefiting private individuals.

“THE SCHOOL PAID OFF THE $6,500,000 BOND PAYABLE AS OF SEPTEMBER 30, 2014. THE FUNDS USED TO PAY OFF THE BOND PAYABLE INCLUDED CURRENT FUNDS, SMALL LOANS, CONTRIBUTIONS AND THE DEEDING OF THE SCHOOL’S REAL PROPERTY AND IMPROVEMENTS, AND FACILITIES TO AN LLC OWNED 50% BY AN INVESTOR AND 50% BY THE SCHOOL.

KONNI MCMURRAY, IN ADDITION TO HER HUSBAND BRIAN, HAVE A 50% OWNERSHIP INTEREST IN ONS INVESTORS, LLC. SANDHILLS INDEPENDENT SCHOOL CORPORATION OWNS THE OTHER 50% INTEREST IN ONS INVESTORS, LLC.” – 2014 Tax Return Schedule N

Improper Valuation Yields Personal Gain

Though hailed as a financial success and celebrated as part of the vision to complete the campus, the transaction came at a significant cost. In the prior year, the campus was valued at $16,863,571 before depreciation and $11,762,335 after depreciation. However, the transfer value was based solely on the $6,500,000 bond balance rather than the fair market value, resulting in a significant undervaluation of the property. Tax filings report the school lost $4,425,663 in assets because of this deal. These assets, including land and buildings paid for in part by generous donors over decades, were sold during what appears to have been a time of desperation.

Even if the McMurrays paid off a large portion of the bond amount, their 50% stake was likely worth significantly more, resulting in an immediate personal financial gain. Notably, the McMurrays appear to have been the only donors to receive ownership in exchange for contributions, raising questions about whether other donors in The Landmark Society—22 philanthropists credited with eliminating the debt—were aware of the implications of this arrangement. While the Head of School publicly highlighted this as a milestone achievement, he concealed the fact that half of the property’s ownership had quietly shifted into the hands of a Board member.

“This area will be called the Landmark Garden in honor of the group who … made the O’Neal Campus complete and fully in possession of the school.” – John Elmore, Former Head of School

Donations Boost Campus Value

Fundraising campaigns have continued to generate capital for major property enhancements, including:

-

2017: Pool renovations and upgrades to Taws Hall

-

2022: 50 Growing Strong Central Campus construction

-

2024: Dining Commons renovation

These improvements have directly helped increase the value of the real estate to $28,985,770 (Twenty-Eight Million Nine Hundred Eighty-Five Thousand Seven Hundred Seventy Dollars) according to Moore County Property Tax Records.

Donors Kept in the Dark

Donors remain largely unaware that their contributions benefit a campus partially owned by private investors and instead believe that their gifts solely support the school. Audited financial statements outlining the ownership structure are restricted to Board members, further limiting transparency.

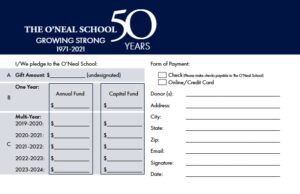

While public tax returns include details about the transfer, these documents are rarely reviewed due to their complexity. Fundraising materials like the O’Neal Seasons of Giving and the donation pledge card also fail to disclose the campus’s partial private ownership. Additionally, the tax returns lack a breakdown of their “Leasehold Improvements,” leaving unanswered questions about how donor funds were allocated or what portion was used for improvements not fully owned by the school.

The McMurray Family’s Influence

Konni McMurray was Treasurer when the school took on significant bond debt and later served as Vice Chairman when the Board approved transferring campus ownership to her and her husband. Although their children no longer attend O’Neal, she has remained an active Board member for years, likely to safeguard their financial investment. The central campus courtyard was named “Konni’s Courtyard” in her honor, even though her decisions played a key role in the school’s financial troubles. Meanwhile, Brian McMurray, as Manager of both Sandhills Independent School Campus Association LLC and ONS Investors LLC, retains nearly complete control over the campus assets with no independent oversight despite his ownership being split evenly with the school.

Ethical and Regulatory Violations

This arrangement raises multiple areas of potential regulatory scrutiny, including:

- Private Inurement and Excess Benefit: Private individuals, such as the McMurrays, appear to have gained financially from their involvement in the campus transfer which is prohibited in non-profit organizations.

- Conflict of Interest: Konni McMurray’s roles as a Board member and co-owner of the campus created an inherent conflict that undermined impartial decision-making.

- Asset Undervaluation: The campus was undervalued during the transfer, with its price tied to the bond balance instead of fair market value.

- Misrepresentation of Donor Intent: Donors believed their contributions were solely supporting the school, but funds enhanced assets partially owned by private individuals.

- Lack of Transparency: Critical details about the ownership structure and transaction were withheld from donors during fundraising campaigns.

- Fiduciary Duty and Oversight Issues: The Board’s decisions prioritized short-term private interests over the school’s long-term financial health.

- Improper Leasehold Improvement Classification: Donor-funded upgrades were classified as Leasehold Improvements, hiding their role in increasing privately owned asset value.

- IRS and State Non-Profit Governance Compliance: The circumstances surrounding the transaction may violate federal and state regulations for non-profit operations.

History Repeating

The same individuals responsible for the financial mismanagement that led to the school’s earlier crisis remain in control, now driving the organization into a reputational disaster while attempting to hide its wrongdoing. Stan Bradshaw, instrumental in hiring John Elmore—who “resigned” under questionable circumstances—was once again tasked with selecting the new Headmaster. Whether this leadership change marks a turning point or signals the continuation of over a decade of unethical practices remains to be seen.

Although the institution still bears the name “The O’Neal School,” its founding ethics and principles have been profoundly compromised. Donors and supporters must consider whether their contributions preserve the school’s legacy or sustain an organization that no longer reflects its original mission. Perhaps a more fitting name would be “The McMurray School,” as the true spirit of what O’Neal once represented has long since faded.